Many medical students married or single are paying to work over 80 hours a week of intense study or on their clinical rotations over the course of four years. The cost of medical school and maybe more so the compounding interest accumulated after graduation is one of the biggest stressors for a medical student. Some people refer to a career as a doctor as a “million dollar mistake” when taking into account 10 years of lost pay during the training years and nearly a half-million dollars of interest accrued before paying off student loans. I’m not sure I would label it a “mistake” but the comment, “When he is a doctor, you won’t have to worry about money anymore,” makes me feel misunderstood. For a husband, the weight to provide financially for his family now rubs up against these all-consuming hours of unpaid work. With tuition on the rise and a federal cap for graduate student loans, couples in medical school are constantly trying to figure out how to financially make it through medical school.

For months I have desired to write a blog post on how we have financed medical school but in fear of judgment from the non-medical community reading this, I hesitated. This blog post sums up my personality. A lot of vulnerability, some humor to keep life from being overwhelming, and of course a few practical financial solutions.

When Tom and I got married I was thirty years old and had plenty saved. My biggest monthly paycheck since graduating college was short of $3,000 (less than $36,000 yearly income), but saving and investing had become a habit. I had saved many financial gifts and inheritance since high school. With the average American being $38,000 in personal debt, excluding a home mortgage, I felt like I was doing quite well. Tom had about $1,500 in undergraduate student loans, which we paid off in the first months of marriage. On the other hand, Tom had spent his last dime on my wedding ring and our apartment’s downpayment. And because he was poor, he qualified for AAMC Fee Assistance Program which saved us thousands of dollars in primary application fees. If you are in the process of applying to medical schools check out my post “When Your Fiancé Applies to Medical School…”

We were DINKs with no credit card debt and no car loans. We both were given our grandmothers’ old cars when we returned from living overseas. Tom driving that purple, Plymouth breeze with the “No God, No Peace. Know God. Know Peace” bumper sticker to pick me up on our first date was of course what drew me to him 😉 Our financial stability and spending/saving patterns before marriage eased our entrance into medical school.

I had also built up years of economic status expectations and privileges. My generous parents always provided for all the extras that my personal budget didn’t allow. Lots of state scholarship funds and my parents had paid for my undergraduate degree. Living overseas in my 20s, I was too far away to attend all the weddings, which was at the time heartbreaking. On the positive side of things, I didn’t have to spend thousands on bridesmaids dresses I would only wear once. When I lived in Thailand I had a lady who worked as my personal housekeeper. One day I had to tell her to please not iron my underwear as I didn’t want to feel obligated to keep them organized in the drawer. Oh, how I miss P’Mon! Coming from an upper middle class and even upper class for Thai living standards, I had expectations. I had expectation for marriage of not necessarily living above our means, but having means…and then medical school started.

I had expectation for marriage of not necessarily living above our means, but having means…and then medical school started.

During Tom’s first year I worked as a teacher in a low-paying county in North Carolina. We lived off my salary plus $300/month in student loans on top of tuition costs to cover his insurance and additional educational resources. AND that box of fake human skeletal bones which one of his teammates “lost”, but never confessed to losing, so we had to pay $275. I mean seriously who loses a trumpet sized case of human bones?! Creepy.

Our daughter was born the summer between M1 and M2 and that is when we decided I would be a SAHM. Between daycare, long work days, no remaining leave days, and the cost of work-related expenses the cost/benefit was pro SAHM. In an attempt to not direct all my type A personality at my first child, I began working for Beautycounter as an independent consultant. If I could bring in a few hundred dollars a month that would be great and if not, I hadn’t invested but a $98 enrollment fee.

When we made this decision we had little idea what government resources were available to us. Several women at our church shared about resources they had used in various seasons for their families. I started talking with other SAHM medical wives and realized they too were receiving benefits. Our savings had dwindled after buying a new car, putting a downpayment on our house, and making several renovations. Although I was still wrestling with being labeled a “low income” family or “needy” or “dependent on the government”, I knew taking out the least amount of student loan debt was the best case scenario long term. Over time we signed-up for any and every available resource to help reduce our monthly out of pocket budget. I began looking at government assistance as “scholar funds” rewarding my husband for his dedication to long-term service in a health profession.

What resources are avaiable?

*not a government resource but a possible financial resource you may not have considered.

Did you know up to $10,000 of your Roth IRA can be used toward qualified high education expenses without an additional 10% tax penalty. I’ll go in more detail in a future post on investments while in medical school. If you have a Roth IRA or are considering one, know that $10,000 from a Roth IRA can be used toward tuition. This results in $10,000 of student loans that can be used toward living expenses instead of tuition, if needed. This tax loophole is beneficial during M2 and M3 with additional board exam expenses and residency interviews. Do take into consideration the current market value and talk with your financial advisor before making this decision.

Medicaid varies from state to state but was fairly easy for us to apply for online and then reapply or add babies as needed. We qualified immediately when my contract ended with the public school system and our daughter was a month old and I was not working. With my business income growing, we will end up losing full Medicaid for Tom and I. The cut off for full Medicaid is $744/month gross income. SHOCKING, right?! That means someone who makes $800/month, not even enough for a 1 bedroom apartment, will have to pay monthly premiums and/or a high deductible for their health insurance. So sad.

The children will still receive CHIP. When Medicaid is no longer an option, we will most likely move toward a Christian share plan rather than a market place high deductible plan. This way we can choose our providers and not have to worry about not having the emergency savings for a high deductible.

Additional Medicaid Tips:

- Full Medicaid is a $3 copay to your primary care doctor, OB/GYN, dentist, an eye doctor.

- Medicaid will retroactively pay medical bills up to 3 months! THIS saved us over $2000 on our daughter’s birth. I had an 80/20 plan and Medicaid retroactively covered the 20% my primary insurance did not cover, since my primary insurance ended with the school year contract.

- CHIP (Children’s Health Insurance Program) can be as low as a co-pay in some states or a monthly premium in other but you will never pay more than 5% of your family’s income for the year. Our son was in the NICU for 10 days and his bill was over $66,000. If I was still teaching we would have had to meet a deductible and pay over $12,000 in medical expenses. I am forever grateful for this government resource at this time in our lives.

In the past food stamps were complicated. Monopoly like money was given with $ value on paper slips to be used at checkout until 2004 when the system switched over to an electronic debit card (EBT). The paper system took extra time at checkout, drawing attention to the recipients. As a child, I remember a negative tone when people on food stamps were brought up in a conversation. Although we have used this resource for over a year I still hesitate to show my card at checkout. By allowing shame to enter, I am breading arrogance toward those on a lower income. Monetary resources should never define how we value another person.

Food stamps, now known as Supplemental Nutrition Assistance Program (SNAP). Student loan $ used for living expenses does not count toward the monthly income.

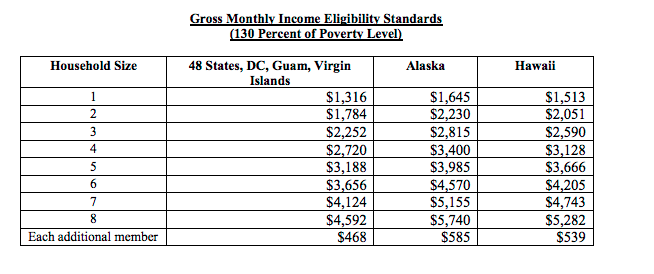

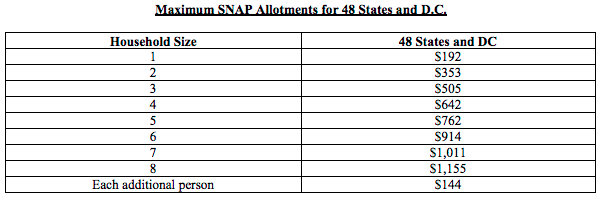

In 2019 the monthly maximum SNAP allotment increased to account for inflation. A full-time student does not qualify for SNAP unless they have a dependent child under the age of 6 years old or between 5-12 without adequate childcare, which allows them to attend school and a 20hr/wk work schedule. For a reference, we are counted as a family of four (medical student, wife, and two children).

Additional SNAP tips:

- Apply with your tax statement and it’s a fairly simple process. Our social worker has been extremely helpful and responsive.

- Getting CASH $$ back (via PayPal) for food purchases using EBT card by using the Ibotta App.

- Freedom to shop organic and free-range meats/eggs and all the dark chocolate your heart desires!

- Works with express checkout at your local Harris Teeter. No more dragging my kids two and under through the grocery store!

- Accepted at Sam’s Club and Costco

- Our grocery store deli (no hot foods) accepts SNAP to use on party trays, cakes, etc. Makes for throwing our kids birthday parties or hosting events affordable. We even use it for our Thanksgiving pre-order prime rib meal. This was a huge blessing because my husband was in a major car accident just days before.

- Our favorite local carry out pizza, Papa Murphy’s approves too!

- Gas Stations, Jamba Juice, Blimpie, Denny’s, Firehouse subs, Dominos Pizza, KFC, and several other restaurants are eligible locations. This can help when a spouse is traveling for rotations or residency interviews.

- Funds roll over, which is very beneficial when planning for the added food expenses of the holiday season.

WIC is also available to families in medical school in all states. If your children have Medicaid you automatically are approved for WIC benefits. WIC also runs on an electronic benefits card and there is an App that keeps track of available benefits and shows items that qualify. The app isn’t the most efficient but I do recommend going old school and looking at the booklet that breaks down what items are available by the grocery store, brand, and food category. WIC does require periodic check-ins with a nutritionist and appointments can be long. SNAP is much more user-friendly and doesn’t restrict brands.

Additional WIC Tips:

- Free high-quality breast pump that was a need when our son was in the NICU for 10 days

- Formula and baby food which can cost $100s a month

- WIC can be combined with SNAP. Two completely separate federal programs.

- They accept the pediatrician’s records of weight and height if you bring the records of the last visits with you to the appointment. *If you don’t bring the records your child will have to be undressed for weight and height.

- Shorter wait times are first thing in the morning.

There is much to be grateful for when it comes to government benefits and know the system can be time-consuming and confusing. Paper trails are not always clear. It can be hard to reach social workers. Rules vary and change by year and are sometimes vague. Sometimes I fill out all the renewal paperwork correctly and still get a notice that we lost benefits because I was missing some document (even if it wasn’t stated clearly on the form). However, we are forever grateful for these resources. In 2018 alone they saved us over $5000 in food and $25,000 in medical expenses (our son’s birth and NICU days and Tom’s car accident).

Do those numbers shift your mindset?

If I was a teacher in the highest paying county near our medical school, even with 9 years on my license I would still only make around $52k. 1/3 of my salary would go toward two kids in daycare, 1/3 of my paycheck toward medical bills, and the final 1/3 of my salary toward insurance expenses. I would have been working over 40+ hours a week and bringing home a net of ZERO DOLLARS. We see how God has provided for our family through government resources. Only he knew all the events that would unfold over the past two years and only he could grow my business in such a way that would meet our remaining financial needs.

Leave a comment below so we can support each other through this season. And feel free to reach out with any questions.

Stay tuned for part two “Budget Saving Tips, Every Penny Counts”.